#Bright line date transaction costs code

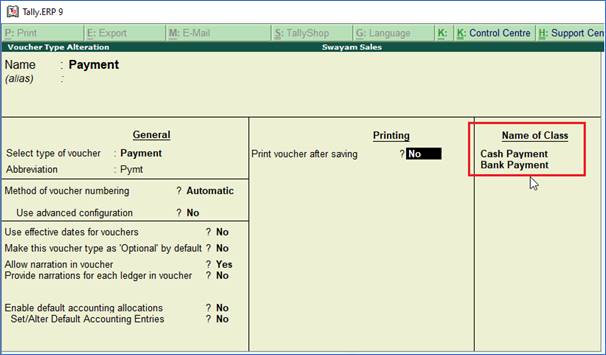

However, an exception referred to as the “bright line date rule” enables taxpayers to deduct some, but not all, of the transaction costs paid or incurred prior to a specific date in connection with the following acquisitive transactions (referred to as “covered transactions”):Ī taxable acquisition by the acquirer, rather than the target, of assets that constitute a trade or business (e.g., a deemed asset acquisition made with an Internal Revenue Code section 338(h)(10) election)

Treasury Regulation §1.263(a)-5 generally requires the capitalization of amounts paid or incurred to facilitate an acquisition of a trade or business, a change in the capital structure of a business entity, and certain other transactions. Because of the potential materiality of the tax benefits at stake, it is important for taxpayers to properly analyze and document their transaction costs. While transaction costs paid or incurred in connection with many types of transactions tend to be capitalized, the IRS and Treasury have prescribed regulations that can often lead to opportunities for companies to claim a current tax deduction for a portion of the costs related to certain acquisitive transactions. Whether related to an acquisition, merger, restructuring, reorganization, initial public offering or spin-off, the costs paid by companies to service providers such as investment bankers, attorneys, accountants and consultants to investigate and pursue a transaction (“transaction costs”) can be in the millions of dollars. The 2021 tax year saw an uptick in M&A activity, and the trend appears to be continuing. Posted by Jonathan Roller on April 19, 2022

Overview – Governments School Districts.Research & Development Tax Credit (R&D).Outsourced Accounting & Advisory Services.

0 kommentar(er)

0 kommentar(er)